georgia property tax relief for seniors

Ad 2022 Latest Homeowners Relief Program. Residents of Georgia aged 62 years and older are exempt from its 6 tax all social security and 70000 per a couple of income on pensions interest dividends and retirement accounts etc.

Property Tax Exemptions In Ga Property Tax Tax Effingham

About the Company Georgia Property Tax Relief For Seniors.

. There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens. Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. The exclusion allows a retiree who is 65 year or older to shield from state income.

A family member or friend can notify the tax receiver or tax commissioner and the homestead exemption will be granted. Check Your Eligibility Today. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Property Taxes in Georgia. Complete exemption from school taxes at. Boasting a population of nearly 11 million Fulton County is Georgias most populous county.

Check If You Qualify For 3708 StimuIus Check. Income based reduction at 62. HB 1055 also eliminates the state portion of homeowners property taxes an idea proposed by Governor Perdue during his 2008 State of the State address.

It was established in 2000 and is a part of the American. Many counties have decided that since you no longer have school-age children and may be living on retirement savings you deserve a break on your property taxes. Ad A New Federal Program is Giving 3252 Back to Homeowners.

Any Georgia resident can be granted a 2000 exemption from county and school taxes. When you are 65 or older the state can issue a tax exemption to you on your home. Individuals 65 Years of Age and Older.

Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and. CuraDebt is a company that provides debt relief from Hollywood Florida. The qualifying applicant receives a substantial reduction in property taxes.

You can exempt yourself from taxes based on your homestead. 48-5-40 When and Where to File Your Homestead. The two tax cuts will.

Other forms of property tax relief for retirees in Georgia include an exemption of all property value accumulated after the base year in which a senior age 62 or older applies. About the Company Georgia Property Tax Relief Age 65. Bartow County Home Exemptions.

School tax exemption of 40K at age 65. A Guide to Claiming Fulton County Property Tax Exemptions for Seniors. Up to 25 cash back Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a.

It was founded in 2000 and has been an active. Dont Miss Your Chance. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your.

People who are 65 or older can get a 4000 exemption. Georgia is ranked with other tax-friendly state such as South Carolina Tennessee Alabama and Colorado due to its low-tax climate tax exemptions tax breaks and affordable. Heres how it works.

Property Tax Homestead Exemptions. Further Georgia has an exclusion from state income tax that is directly targeted at seniors. Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year was 10000 or less you qualify for a 4000 property.

Georgias seniors get property tax breaks in many counties and a special state tax exclusion that was among the factors used by Kiplingers to rank GA 5 as a tax-friendly state for. County Property Tax Facts. Check If You Qualify For This Homeowner Relief Fast Easy.

Its population is diverse. With an expansive lawn. Our staff has a proven record.

L3 - 40000 From Assessed Value for County and School. As Active Adult Experts we. Homeowner must be 62 years of age by January 1st in year of application and net income of.

CuraDebt is a company that provides debt relief from Hollywood Florida. Residents who earned under 100000 in 2021 will get a 300 tax rebate this year with dependents eligible for the rebate as well. Property Tax Returns and Payment.

Currently there are two basic. Hawaii tax rebate check. DeKalb County offers our Senior Citizens special property tax exemptions.

New Yorks senior exemption is also pretty generous.

Deducting Property Taxes H R Block

Property Taxes How Much Are They In Different States Across The Us

How Taxes On Property Owned In Another State Work For 2022

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

State By State Guide To Taxes On Retirees Retirement Lifestyle Retirement Retirement Advice

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax How To Calculate Local Considerations

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

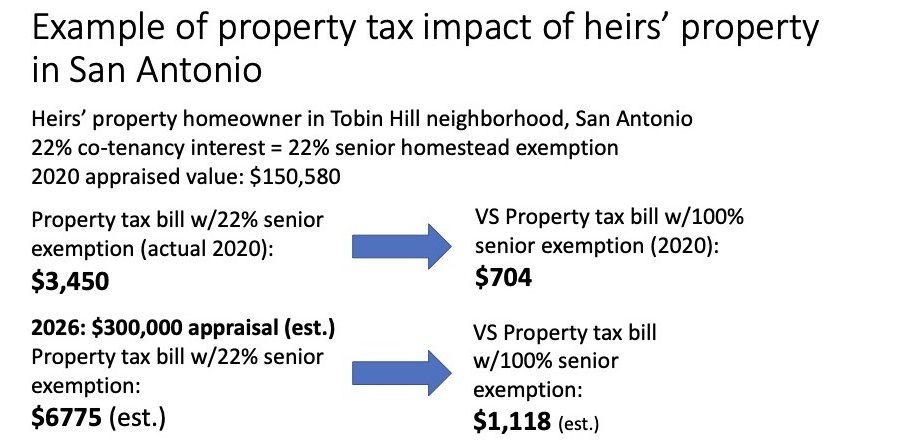

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Personal Property Tax Portsmouth Va

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Property Taxes Property Tax Analysis Tax Foundation

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Tax Retirement Income

What Is A Homestead Exemption And How Does It Work Lendingtree